James Eibisch, Research Director, European Infrastructure and Telecoms, IDC

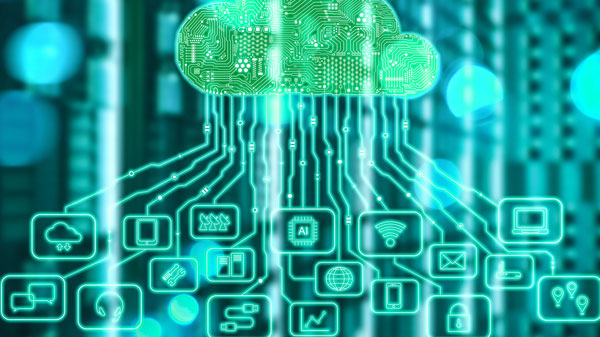

Manufacturing is being disrupted by a mix of macroeconomic and technology forces. Concerns around energy prices, a recession, and other economic factors make it difficult to forecast operational costs and demand outlook. Workforce shortages, supply chain instability, and growing protectionism caused by geopolitical tensions remain pressing challenges. On top of that, manufacturing companies are in the middle of an ongoing technology transformation that will secure their ability to thrive in a digital, cloud-first world for the long term, but that brings its own additional complexity and disruption in the short term.

SD-WAN is at the heart of next-generation networking

Next-generation networking will help manufacturing companies weather the storm and enable that broader transformation. SD-WAN is at the heart of that change. So, how are manufacturers taking their use of SD-WAN to the next level? A recent survey by IDC* sponsored by GTT took the pulse of the industry across the U.S. and Europe to find out.

Around five years since SD-WAN entered the mainstream, nearly half of manufacturing organizations (43%) are currently using or deploying an SD-WAN solution, and a further 50% plan to within two years. While companies will use a variety of transport underlays, SD-WAN is quickly becoming the dominant overlay network architecture, providing application-aware routing and instantaneous failover. And with good effect: significantly more current SD-WAN users report that their network provides good support for their overarching business priorities than do those who have yet to deploy.

How SD-WAN Benefits Manufacturing

Companies use SD-WAN for many reasons, yet manufacturers use it as a key component of their overall technology strategy - more so than companies in other industries. In manufacturing, the standout drivers are to achieve faster network deployment (cited by 38% of companies in their top 3 reasons for using SD-WAN) and to support multi-cloud/hybrid IT architectures (35%). Both reflect the growth of cloud- and edge-based IT in manufacturing as well as the rapid technology shifts taking place in the industry. As a result, improving and integrating security is also a driver for using SD-WAN. Reducing cost, although important, is near the bottom of the list at 23% and the lowest of all industries surveyed.

To help support this strategic view of the network and manage the pace of technological change, manufacturers turn to managed services for their SD-WAN more often than the survey average: 51% of them use a fully managed service and 27% a co-managed service, while only 22% opt to manage their SD-WAN solution themselves in a do-it-yourself (DIY) model. Those DIY companies report several challenges, however, the top ones being mostly skills related (including keeping up with evolving security threats and tools). The most prominent challenge is that manufacturers recognize their inability to negotiate with suppliers, technology vendors, and connectivity providers with the same leverage that managed service providers have. Managed service providers, with their long-standing supplier relationships, buying power, and concentration of skills, are better placed to manage those relationships.

Manufacturing enterprises that use a managed SD-WAN service do so for a wide variety of reasons: the top 2 are managing technology upgrades and getting better protection against security threats. Both reasons relate to a skills shortage, a major challenge of DIY networks and a core driver of managed services. The fact that getting better security protection is the number 2 reason for using a managed service says a lot about the difficulty of keeping up with ever-changing attack vectors.

Even though many manufacturers are drawn to managed service providers for their security capabilities, nearly half of those surveyed are not using those capabilities to the fullest. A quarter (23%) use add-on, best-of-breed security that is not integrated with their SD-WAN, and a similar number (24%) have no SD-WAN-specific security solution at all. A managed SD-WAN service doesn’t have to be coupled with an integrated, managed security solution and organizations need to identify which security option works for them, but the prevalence in manufacturing of remote and unmanned sites, as well as the growth of remote/home working, call for simplifying security provisioning, which can be achieved through integrated and managed solutions. Due to these factors, 39% of manufacturing companies rate Secure Access Service Edge (SASE) as a high priority, reflecting the value of a converged network and security solution.

Finally, the same number, 39%, have already taken steps to integrate their networking and IT security teams within their organization. This is an understandable issue particularly in manufacturing as networks need to support complex and often bespoke IT/OT environments, and security should be a holistic approach across the whole environment, rather than added to individual components in isolation.

The survey has shown that the manufacturing industry is at the leading edge of using networks for strategic advantage, and its use of managed SD-WAN services with a road map toward a managed SASE framework is an important part of that.

* GTT and IDC recently surveyed 650 large enterprises across Europe and the U.S. to understand how companies are taking their use of SD-WAN to the next level, and how they are integrating network and security solutions. Manufacturing was the largest industry sample, with 140 respondents across all countries.

FAQs:

How secure is SD-WAN?

https://www.gtt.net/us-en/becybersmart

What is the difference between Managed SD-WAN and SD-WAN?

https://www.gtt.net/us-en/services/secure-networking/managed-sd-wan

What kind of businesses use SD-WAN?